How to start a cross -border EC to Canada? Differences from the United States, which you do not know unexpectedly

Thankfully, recently, digital marketing, new EC site construction in SHOPIFY, and site renewal inquiries have increased.

Among them, as the number of companies that are considering business development not only in Japan but also overseas is increasing, I have the impression that most of them are set in Asia or the United States.

So what about Canada, the neighbor of the United States?

Our company is also officially certified, and SHOPIFY, the largest E -commerce platform, is developed in Ottawa, Canada and has its base.

For this reason, Canada supports SHOPIFY and supports the country, and its high level of living and satisfaction with the residents are at the top level compared to other countries.

This time, I have summarized the contents of the Delivery rules and TAX in Canada after receiving inquiries about launching a cross -border EC from Japan to Canada.

* This article is not an alternative to the official information by the government, so please check it in detail with a tax accountant who has been contracted for reference only.

Index

What is the shipping cost from Japan to Canada?

When sending luggage (product) from Japan to Canada, if the value of the luggage is $ 20 or more, the federal added value tax (GST), the state / sales tax (PST), and the unified sales tax (PST) combined with these two taxes ( You need to pay HST).

These are different types of taxes depending on the destination of luggage (product). For example, in British Columbia in Canada, only the state / sales tax (PST) is applied, and in Ontario, unified sales tax (HST) is applied. Furthermore, if the state / sales tax (PST) is applied, the tax rate varies depending on the state, so it is not a standard that is taxed together and a state that is not.

Most states in Canada are subject to tax, but for those that are essential in everyday life, taxes, drugs, and medical devices do not apply tax.

In addition, some states are not subject to tax even if they send unnecessary products.

Oh, I can't remember ...

Is the tax paid by a company? Or will you pay?

As in Japan, in the United States, if you purchase goods on an online site of American companies, taxes will always be added to the total amount.

So what about Canada?

In Canada, when purchasing products online, the tax rate applied to your state is added. The question here is that there are rarely online sites where taxes are rarely added. (I think it can almost exist these days)

In that case, you may think that the site you operate is not a good or dangerous company, but this is because the company pays the taxes to be paid.

Of course, it was not billed online, but it was charged by the delivery company the moment the luggage arrived, but this pattern is even more rare.

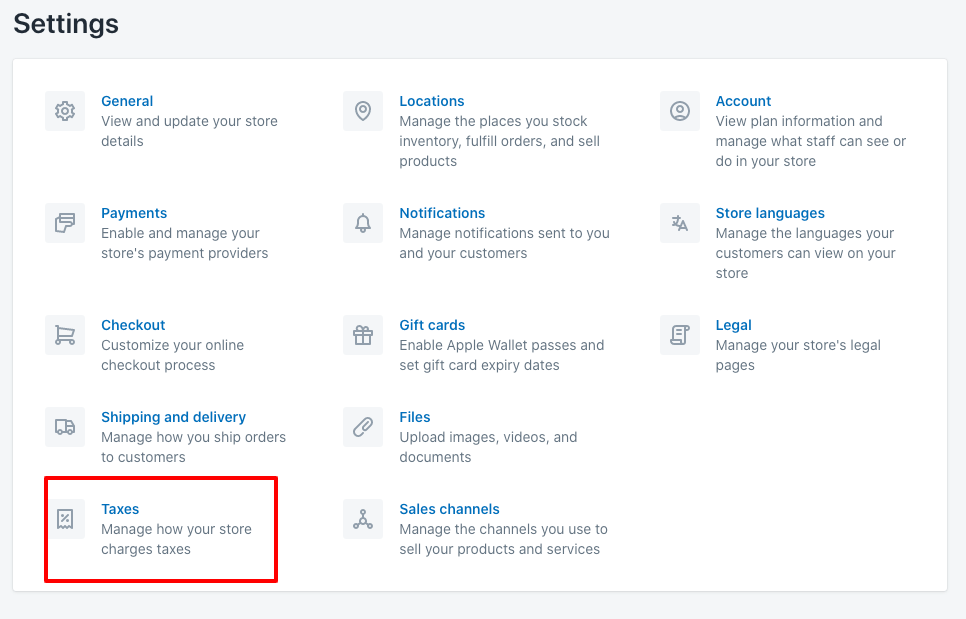

Companies that we consulted with us would like to pay the tax, and since we were considering building a site on SHOPIFY, check the setting screen, which vary greatly from American settings. I was surprised because it was a more complicated screen.

After checking the setting method in detail, in Canada, if you pay taxes, you need to register with the Canadian tax authorities (necessary state) and register the tax ID to be granted there on the Shopify setting screen. I understand that.

If you pay a 100%tax from a customer, you will be able to automatically request a suitable tax from your delivery address by filling out the tax rate and TAX ID for each state. Since the tax varies from state to state, the settings that automatically claim this are unique to SHOPIFY, which specially for cross -border EC.

As expected, the birthplace of SHOPIFY! !

Is a Canada TAX ID required?

As I mentioned earlier, if you collect taxes from customers, you need to register with the state tax authorities and get a TAX ID. (Reports to be submitted to the tax authorities are also required, but I will omit it here.)

In Canada, if you sell taxes or services that are subject to tax, you must register with a GST/HST account if the global revenue exceeds 30,000 Canadian dollars in the last 12 months.

Therefore, if the profit in Canada does not reach $ 30,000, if the revenue in Japan exceeds the $ 30,000 Canada, it is necessary to register with the tax authorities and acquire a TAX ID.

In addition, you need to get a TAX ID, but also include taxes on your sales in an appropriate tax authorities and submit a regular report.

Conversely, if the sales are lower than the specified value, there is no need to collect taxes from customers without registering with the tax authorities, and do not need to collect or remit the tax.

If your company sells goods in Canada, or if you collect taxes from customers, please consult with the tax accountant if you do not need to register with the tax authorities.

Please use the information here only for reference.

I set a Canadian tax in Shopify

The setting was very easy.

First, select "Taxes (tax)" from the Shopify setting screen.

You can select a Canada in an area for taxes, and select whether you want GST / PST, and HST as follows on the Canadian tax setting screen.

If you choose to collect taxes from the customer, you will be required to enter a tax ID. (If a company does not need a TAX ID, it is possible to save the settings here even in the blank).

As a result, SHOPIFY will automatically make a request depending on your delivery address.

complicated. 。 I thought it was crying, but a very kind setting screen!

bonus

What did you think.

When I looked around the tax, the contents were surprisingly simple.

The tax settings in SHOPIFY seemed to be complicated at first glance, but the content was very kind, and it automatically collects taxes by each state, so get a tax ID and get an appropriate flow. If you can do it, business development in Canada is realistic.

This time, we investigated Canadian taxes and tariffs at the request of the client who consulted, but I would like to investigate other countries in the event!

I wonder if the tax master for each country. 。